2025/04/08Views(11987)Reviews(0)

I. Target Audience

Warehouse, Operations

II. Feature Introduction

The FBA Inventory System - Batch Management feature is one of the functions of the First-In, First-Out (FIFO) module, used to view and manage FIFO deduction batch information, and supports manually resetting product costs.

【First-In, First-Out (FIFO)】Introduction

SellerSpace's FIFO feature is designed for Amazon FBA inventory. It summarizes on-hand, replenishment, FBA inventory adjustment, and returnable inventory, implementing a first-in, first-out deduction model. This solves the problem of inconsistent product costs due to different shipment batches and logistics fees, which are difficult to track manually. It helps sellers accurately calculate profits and reduce manual labor costs.

1. Deduction Batch Generation Logic:

The system generates corresponding deduction batches based on the order in which the product's FBA inventory enters the Amazon warehouse.

Deduction batch inventory categories: 【Beginning Inventory】 and 【Shipment Replenishment】 inventory.

Taking May 6, 2022, the feature launch date, as the dividing line:

FBA inventory before May 6, 2022, because the order of inventory entry into the warehouse cannot be determined, is uniformly classified as 【Beginning Inventory】, and this batch of inventory is deducted first;

For FBA inventory after May 6, 2022, the system automatically obtains the order in which it enters the Amazon warehouse and generates corresponding deduction batches, namely 【Shipment Replenishment】 inventory, which is deducted sequentially according to the time order.

If it is a store authorized after the feature launch, the authorization time is the dividing line:

FBA inventory before the authorization time point is uniformly classified as 【Beginning Inventory】;

FBA shipment inventory after the authorization time point, according to the warehouse entry time order, produces corresponding deduction batches, namely 【Shipment Replenishment】 inventory.

2. Inventory Deduction Rules:

- Deduct inventory sequentially according to the logic of first-in, first-out, and apply the corresponding product cost;

- If there are product returns, they will be returned to the corresponding batch. For subsequent inventory deductions, the system will automatically prioritize deducting returned inventory. For example, if there are returns for orders before May 6th, they will be returned to the beginning inventory and will be deducted first;

3. Product Cost Setting and Application:

- FBA inventory for which outbound delivery is processed in the SellerSpace system: The system automatically synchronizes the shipping cost, including: product cost, first-leg logistics costs, and other costs, and applies the corresponding cost and expense according to the allocation method set for shipment. Click to view how to ship FBA

- FBA inventory that is not shipped through the SellerSpace system: The cost defaults to 0, and you need to manually set the product cost and logistics costs, etc. through the 【Reset Cost】 function. See the text below for operation methods.

4. Inventory Deduction Type Description:

- Divided into 7 major types: Order Placement, Order Cancellation, Order Return, Seller Return, Inventory Adjustment, Shipment Adjustment, Beginning Adjustment.

- All types are synchronized Amazon deduction types, not judged by the SellerSpace system itself.

III. Usage Scenarios

- View the deduction batches, statuses, and corresponding cost information of product inventory;

- Modify the product cost of the corresponding deduction batch to ensure accurate profit calculation.

IV. Operation Guide

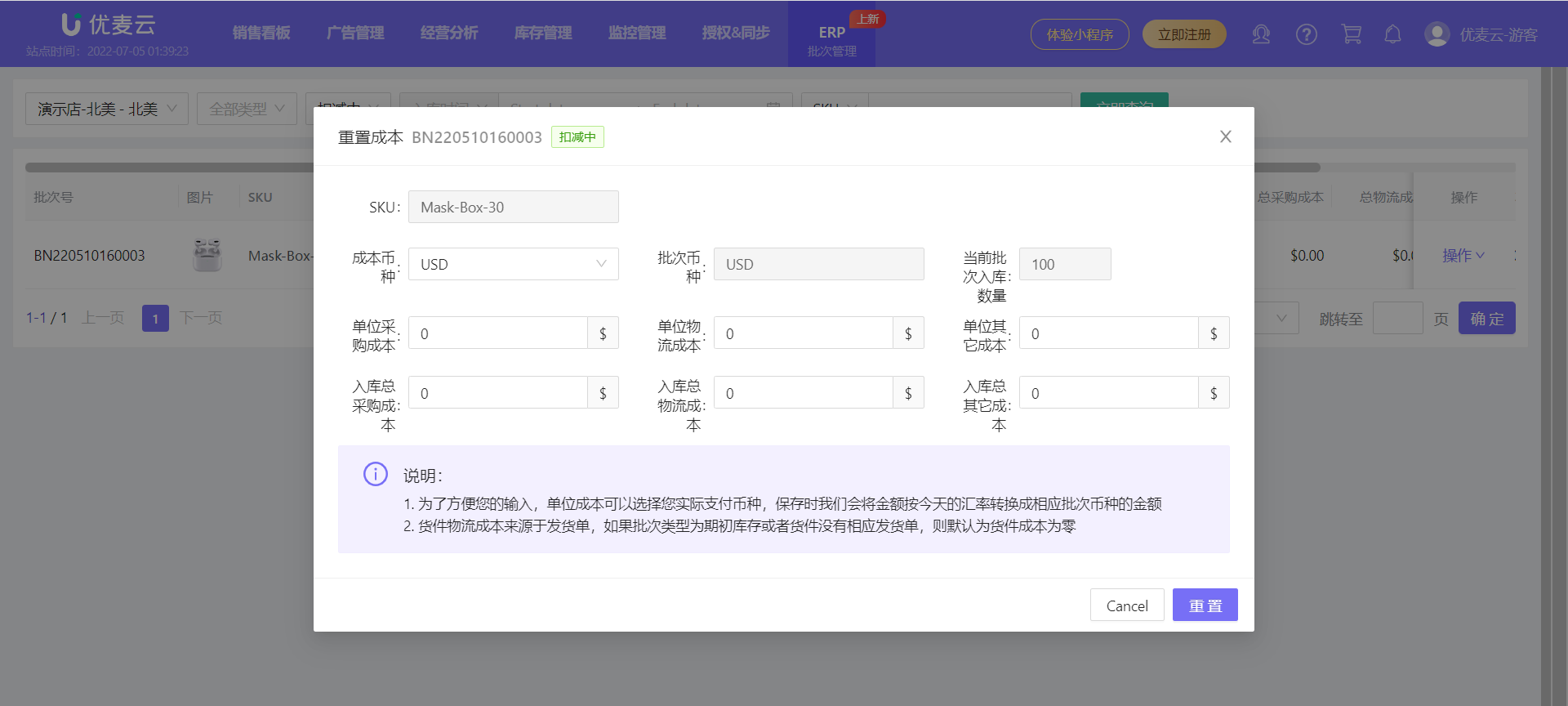

1. Reset Product Cost

If you process shipments in the SellerSpace system, the system will automatically synchronize the product cost and first-leg freight at the time of shipment when generating batches. If the batch cost changes and you want to adjust it, you can choose to reset the cost.

Find the product inventory batch for which you want to adjust the cost, click 【Operation】 on the right, and select 【Reset Cost】 to enter the settings;

+

+

Set the corresponding product cost information, and click 【Reset】 to save.

+

+

Special Notes:

- Resetting the cost is for the entire batch and is not related to the deduction status. That is, the reset cost will also be applied to the already deducted inventory cost.

- If you are using FIFO to calculate costs for the first time, pay special attention to the batch product cost. If it is 0, you need to reset the cost to ensure the accuracy of profit calculation.

2. View Inventory Deduction Batch Information

Here you can view all information of each product inventory deduction batch, as well as product inventory inbound details and deduction details.

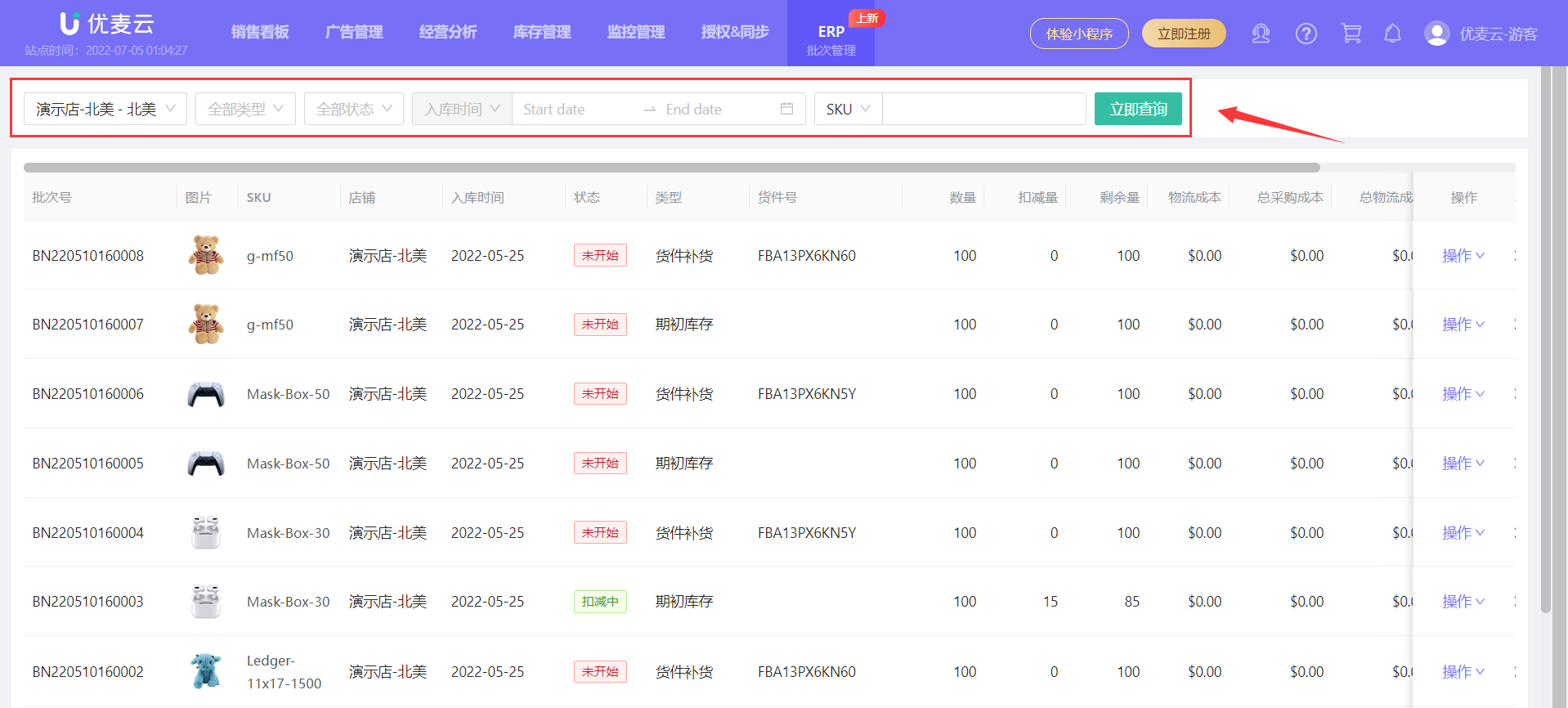

1) Filter to View Batch Information

You can filter by store, inventory type: Beginning Inventory/Shipment Replenishment, deduction status: Not Started/Deducting/Deducted, inbound time, and batch information: SKU/Shipment ID/Batch ID, etc., to filter and view corresponding batch details.

+

+

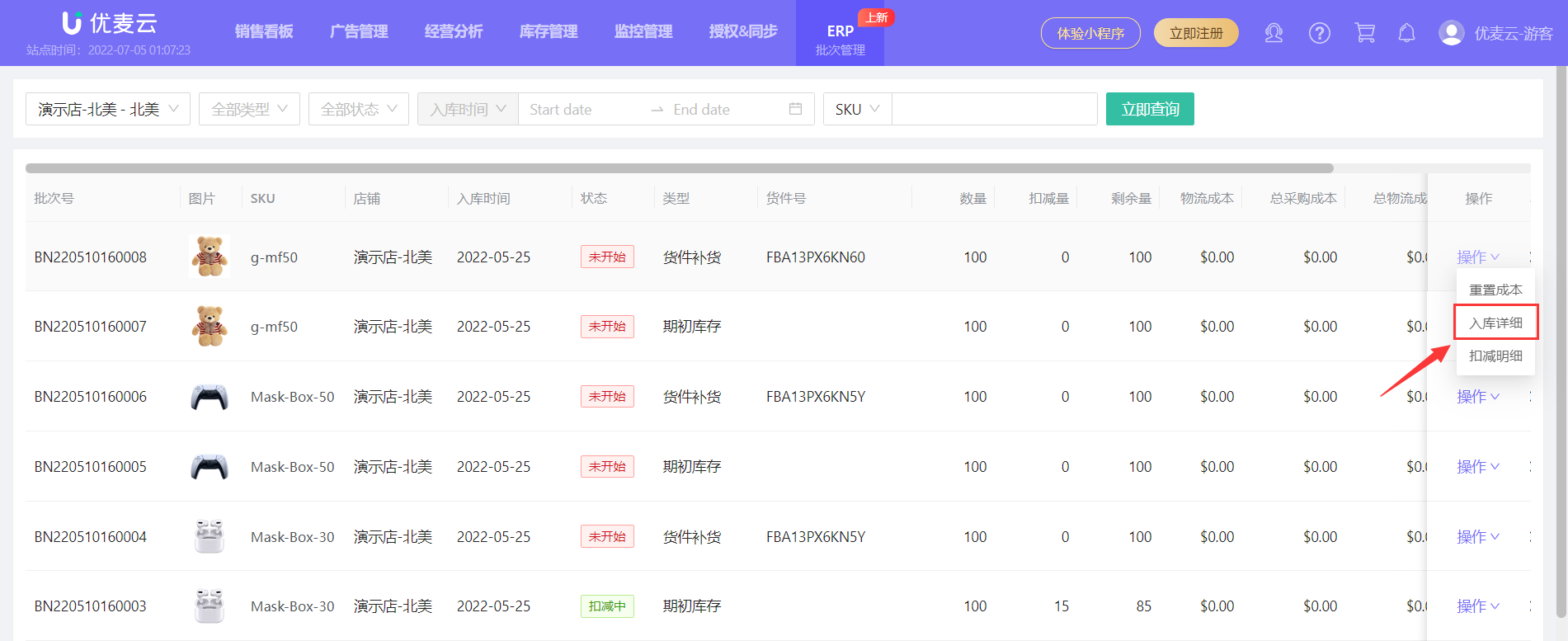

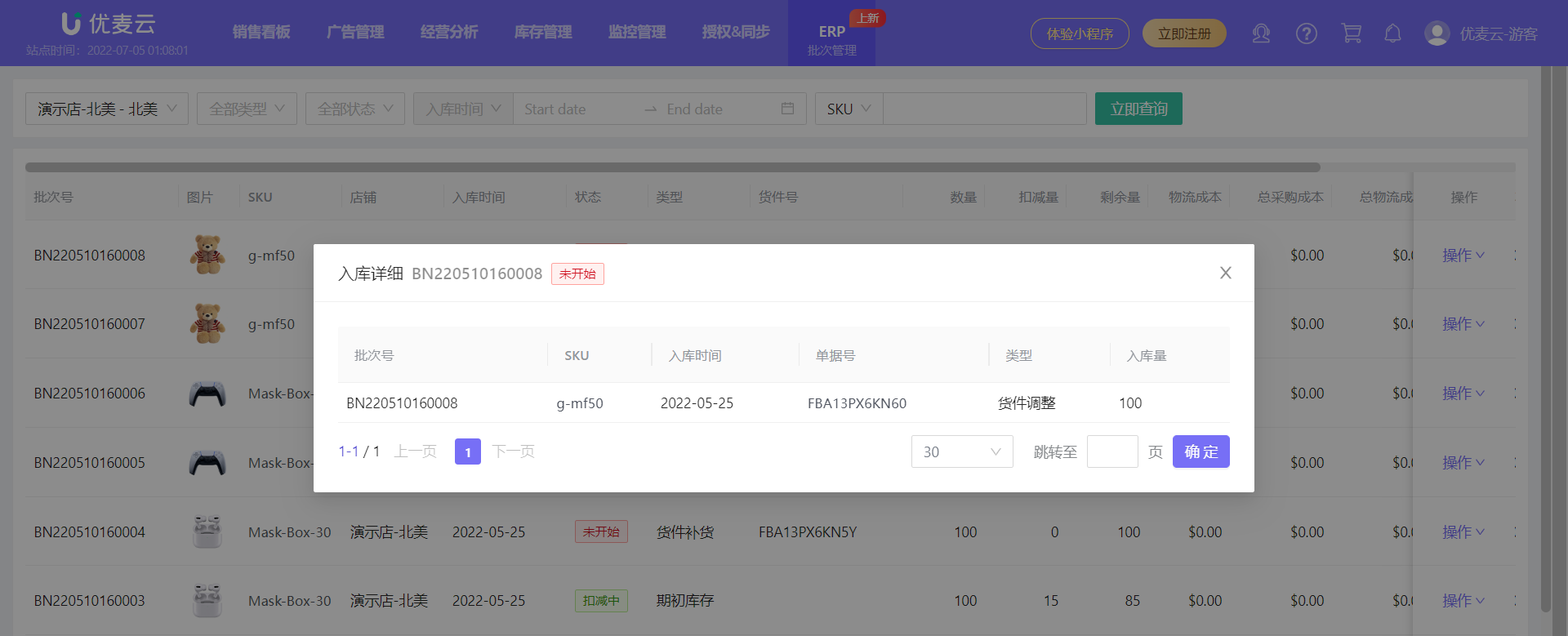

2) View Batch Inbound Details

You can view the inbound details of a single batch of products, including: Batch ID, SKU, Inbound Time, Document No., Type, and Inbound Quantity.

Find the corresponding product batch, click 【Operation】 on the right, and select 【Inbound Details】 to enter and view;

+

+

Single batch inbound details:

+

+

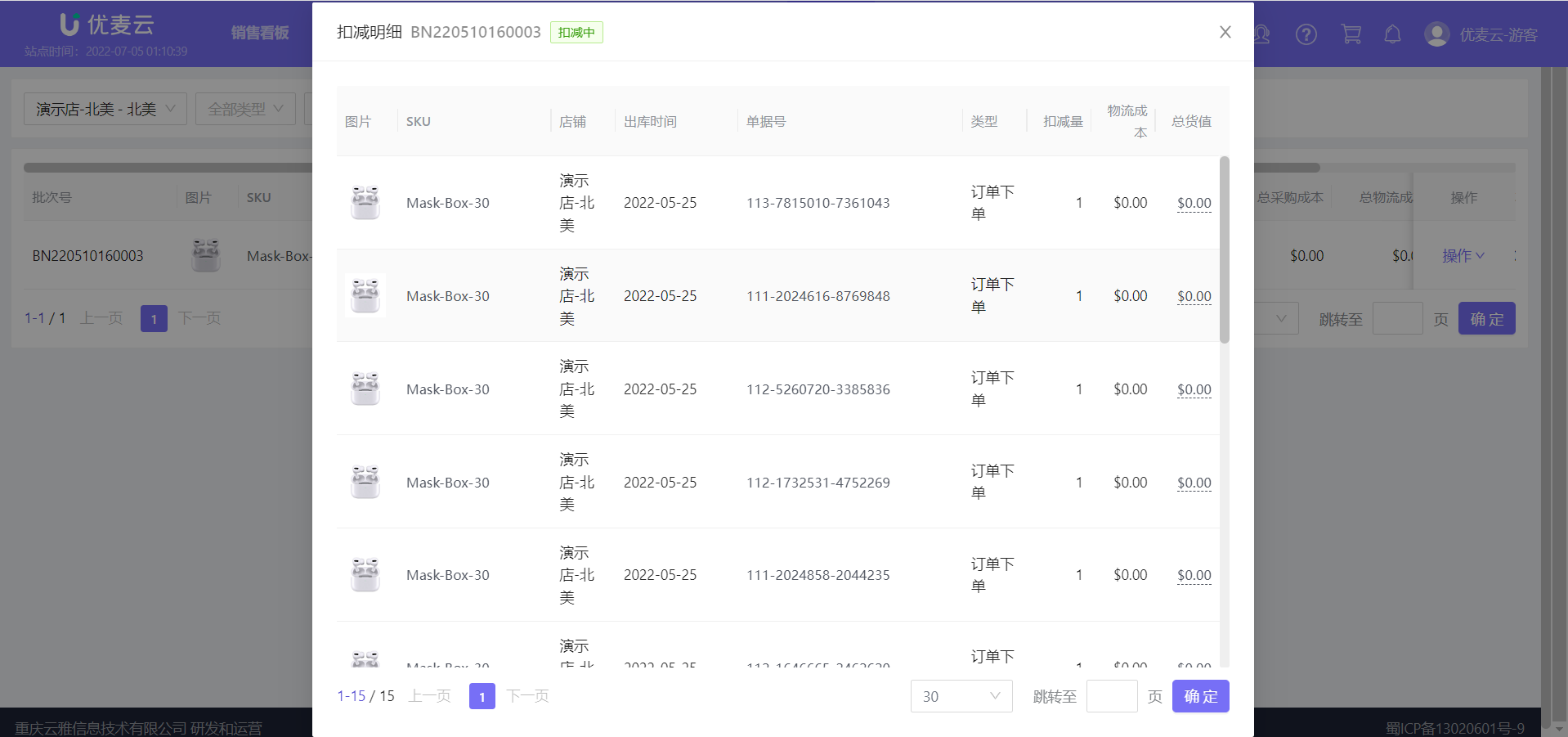

3) View Batch Deduction Details

You can also view the deduction details of a single batch here, including: Product SKU, Store, Outbound Time, Document No., Deduction Type, Deduction Quantity, Logistics Cost, and Total Value.

Find the corresponding product batch, click 【Operation】 on the right, and select 【Deduction Details】 to enter and view.

+

+

Deduction details example:

+

+